In the rapidly evolving landscape of Malaysia’s parking industry, the digital transformation wave that swept through 2023 has continued to leave a significant mark. Parking requirements for building owners have grown increasingly sophisticated, now considered a pivotal component of building management ecosystems. As we venture into 2024, the challenges faced by conventional parking solution providers are set to intensify, with the extension of smart parking systems into smart buildings and townships, transcending traditional parking scopes.

For the commercial parking industry, the surging demand for cashless and touchless methods undermines the cashless approach. The License Plate Recognition (LPR) system has maintained its dominance due to the absence of RFID contenders, especially in meeting the demand for cashless and touchless options, a trend expected to further expand in 2024. This expansion is primarily driven by unofficial but credible reports suggesting the abandonment of the Touch ‘n Go RFID system in the parking industry. There are hardly any other potential RFID contenders besides Touch ‘n Go, given the challenges of user acquisition.

A new trend on the horizon is the adoption of eWallet Direct, which promises a seamless parking experience. With this system, parking fees are deducted directly from users’ eWallets as they exit the parking facility, eliminating the need for physical payment processes. The expectation is that more eWallets will integrate with LPR solutions, expanding their payment ecosystems. The once-dominant Touch ‘n Go in the realm of cashless parking may gradually give way to LPR solutions, now shared among multiple eWallet providers.

Here’s a closer look at the parking trends in 2024 and their implications:

Cashless and Touchless Dominance

The balance of power in the cashless era is shifting slowly away from Touch ‘n Go, which almost monopolized cashless parking in West Malaysia, to parking solution providers. This shift is occurring because LPR solutions can seamlessly integrate with multiple eWallets for a single parking site, allowing providers and site owners to determine the priority of deductions. This change emphasizes the importance of seamless parking experiences, eliminating the need for users to roll down their car windows to tap their Touch ‘n Go cards or bank cards.

Lower MDR with LPR System

In the cashless parking era, parking owners no longer need to bear the averagely 2.5% Merchant Discount Rates (MDR) associated with payment services such as Touch ‘n Go and credit card. Multiple eWallet providers are driving competition and offering lower MDR rates. This shift benefits parking owners, who can maximize their income by choosing the eWallet with the best terms. For instance, consider the scenario where eWallet A offers a competitive Merchant Discount Rate (MDR), despite having a relatively smaller user base and a more limited collection of registered car plate numbers. In contrast, eWallet B may present a slightly higher MDR, but it boasts a substantial user base and an extensive pool of registered car plate numbers. In response to the preferences of parking owners, the License Plate Recognition (LPR) parking solution provider can readily configure the system to prioritize deductions from the eWallet offering the lower rate.

Enhanced LPR Accuracy

License Plate Recognition technology has made substantial strides in accuracy, thanks to AI and machine learning. The accuracy rates have reached impressive levels up to 99.8% and above for standard car plates, reducing errors at entry and exit points. Besides, solution providers also can enhance the LPR accuracy by applying two or three factors authentication method. As accuracy continues to improve and LPR gaining the popularity, it’s likely that car owners with unconventional license plate fonts may opt for more standard designs to avoid complications at the parking sites.

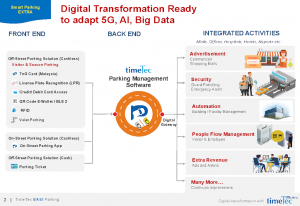

Integration with Smart Ecosystem

In reality, parking is never a standalone activity; however, conventional parking systems are usually incapable of associating parking with other activities. Thanks to digital technology and License Plate Recognition (LPR), parking systems are increasingly being integrated into smart buildings, townships, and cities. Features such as ‘find my car,’ availability checks, promo codes, visitor management, and season parking are now seamlessly integrated into emerging location-based super apps for an increasing number of projects.

Parking and Building Data Analytics

Parking data, once confined to financial and operational monitoring, is now being harnessed for more profound insights. Parking analytics is in its infancy, but the potential for prescriptive and predictive actions, as well as cognitive analytics, is emerging. Data from parking systems can be combined with other building activity information such as visitor management, commercial and promotion activities to enable transformative business decisions.

Reduced Hardware Costs

The era of significant hardware investments in parking equipment is dwindling. Cashless payment methods have driven down the hardware investment by eliminating the once costly auto payment machines, replacing them with simpler payment kiosks at the parking entrances and exits. And the trend of License Plate Recognition (LPR) cameras replacing the payment kiosks or even parking barrier at the entrances is further driving down hardware costs.

The Ascendance of Cloud Parking Systems

In 2024, the majority of parking facilities are expected to transition to cloud-based parking systems. The flexibility, scalability, and efficiency of cloud systems are becoming increasingly attractive to both parking owners and operators. The evolution of parking solutions is shifting from a hardware-centric approach to a software-driven model, empowered by the capabilities of cloud computing technology.

Scaling to Multiple Buildings and Locations

As parking technology evolves, it is becoming easier to manage multiple buildings and locations under a unified parking system. This trend is empowering property developers, building owners and parking operators to streamline their parking operations and provide a seamless experience to users across various parking sites.

In conclusion, 2024 is poised to be a transformative year for the Malaysian parking industry, with cashless and touchless solutions, improved LPR accuracy, enhanced integration with smart ecosystems, and the rise of parking analytics, all contributing to a more efficient and user-friendly parking experience. This era of change promises to benefit both parking owners and users, as well as propel the industry towards a brighter and more connected future.

About TimeTec

TimeTec Group, established in the year 2000, has not only thrived but has also marked two fruitful decades of growth. During this time span, the Group has nurtured and developed three internationally acclaimed IT brands – FingerTec, TimeTec, and iNeighbour. These brands have garnered global recognition for their contributions to workforce management, security, smart parking, office and residential solutions, as well as smart township innovations. At their core, these solutions harness the potential of cutting-edge technologies like biometrics, cloud and edge computing, IoT, and AI, revolutionizing the work and home life landscapes within a larger ecosystem.Through an extensive and robust network, TimeTec Group has distributed its biometric hardware products and an impressive array of in-house developed 18 cloud applications, which include IoT devices, to an extensive clientele spanning across more than 150 countries worldwide. Feel free to explore our company website: www.timeteccloud.com

TimeTec’s solutions have been adopted by numerous renowned clients, with names such as Technology Park Malaysia, IOI Properties, Putrajaya Holdings, Ibraco, Binastra, Thriven, Hock Seng Lee, QSR Brands, Central Sugars Refinery (CSR), Sunway Constructions, Mamee, Yakult, Nano Malaysia Berhad, KL Tower, and many more prominent entities finding value in our versatile and practical products. The appeal of TimeTec’s offerings extends beyond borders, attracting a diverse international clientele from locations as varied as Hong Kong, Dubai, Australia, Qatar, South Africa, and beyond.